Nautical Lands Mortgage Investment Corporation

Facts & FREQUENTLY ASKED QUESTIONS

For over 25 years, Nautical Lands Group (NLG) has invited investors through their RRSPs or non-registered funds to invest in its Interim Construction Mortgages. Investors have earned a consistent and steady cash flow from these mortgages and the fund continues to grow. NLG is now poised to build more retirement communities in an industry with a proven track record for growth. By utilizing the NLMIC, NLG lowers costs in relation to traditional financing methods and is able to streamline all of the business processes to achieve consistent returns for investors and a constant flow of funds between projects.

Investors in the MIC continue to experience steady yields with very low-cost investments, as they have since its inception. Investors will reap dividends from our experiences and successes, along with the knowledge that their investments are secured by mortgages on solid assets in our growing industry.

Five-year history of Nautical Lands Mortgage Investment Corporation

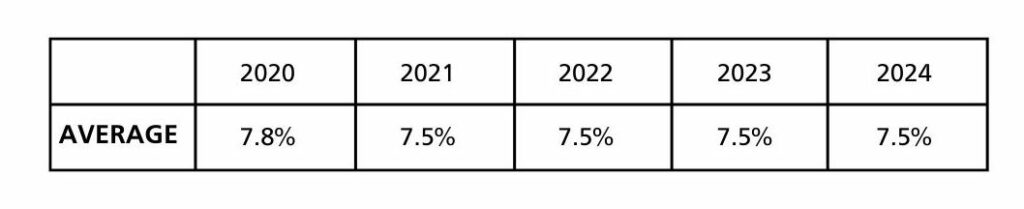

AVERAGE HISTORY OF ANNUAL DIVIDENDS PAIN 2020-2024

A mortgage investment corporation (MIC) is a corporation where individual investors, either directly or indirectly with an RRSP, TFSA or RRIF, pool their investment capital through the purchase of the shares of the MIC, which are then deposited with Computershare Trust. The NLMIC lend monies by way of mortgages exclusively to Nautical Lands Group projects. The mortgage portfolio is continually managed and the proceeds from repaid and discharged mortgages are used to fund new mortgages. The NLMIC may issue more shares to raise additional capital.

The NLMIC’s net income is paid out to the shareholders by way of dividend and our income is derived from mortgage interest. The dividends received by shareholders are treated as interest income for taxation purposes. Any expenses for the NLMIC are administrative, accounting, and other related professional fees.

Investors in the NLMIC will benefit in the following ways:

- Steady returns by way of pooled mortgages

- Bricks- and mortar-backed security.

- Strong, experienced management with a proven global track record, operating in a growing industry within a recession-proof real estate sector

Yes, they are qualified for both registered and non-registered investments.

In order to liquidate your investment, the MIC would have to redeem your shares for the subscription price paid. Requests for redemption are processed every quarter, provided a 90-day advance notice has been given to the MIC and there are available funds for redemption. If funds are not available, the shareholder must wait until the next quarterly redemption in which funds are available. Requests are granted on a first-come, first-serve basis.

Nautical Lands Mortgage Investment Corporation provides you with all the paperwork required to transfer your account.

Yes. Over the last 23 years, Nautical Lands Group has successfully built a unique low-risk business model creating exceptional retirement communities in underserved rural Canadian markets. It has created many new jobs not only in the construction of its communities, but also in the ongoing management and staff working in these communities post-construction.

Non-registered investors’ shares are issued in the investor’s name, while registered investors’ shares are issued to the trust company with the investor’s account number noted on the certificate.

The interest payments are paid directly to the NLMIC, who administers the pool of mortgages on behalf of shareholders. Shareholders receive payments by way of dividend and are paid on a monthly basis.

Dean Grant, CPA, CA, is the President,

Edward Bellman, CPA, CA, is the Secretary Treasurer.

- Dean Grant manages the MIC pursuant to the terms of a Management Agreement

- MNP, Chartered Professional Accountants, is the auditor of the MIC

Dentons LLP is the Solicitor of the MIC

Investors receive consistent returns on their investments that are secured by tangible assets. NLMIC distributes earnings to investors on a monthly basis and provides annual blended rates of returns of up to 8%.

Olympia Trust, 1-877-565-0001.